As an Amazon Associate, I earn from qualifying purchases

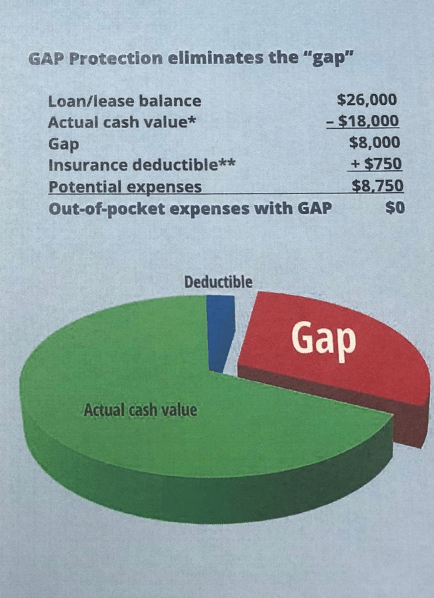

When you buy a new Toyota, you want to protect your investment fully. But do you know what happens if your car is totaled or stolen and you still owe more on your loan than the car’s value?

This is where Toyota Gap Insurance comes in. It’s designed to cover the difference between what your insurance pays and what you owe. If you want peace of mind and avoid costly surprises, keep reading to find out exactly what Toyota Gap Insurance covers and how it can save you money when you need it most.

Credit: www.toyotaoftacoma.com

Toyota Gap Insurance Basics

Toyota Gap Insurance Basics explain how this coverage helps protect car buyers. It covers the difference between what you owe and the car’s value. This coverage is useful if your Toyota is totaled or stolen. You avoid paying more money out of pocket after a loss.

This type of insurance gives peace of mind. It helps drivers avoid big financial gaps after accidents. Understanding these basics is key to making informed decisions.

What Is Gap Insurance?

Gap insurance covers the difference between your car loan and the car’s actual value. Cars lose value quickly after purchase. Sometimes, the loan balance is higher than the car’s worth. Gap insurance pays the gap amount. It protects you from owing more money than the car is worth.

How It Works With Toyota Vehicles

Gap insurance works the same way for Toyota cars. If your Toyota is totaled or stolen, your regular insurance pays the current value. If this amount is less than your loan balance, gap insurance covers the difference. It helps cover the remaining loan balance. This coverage is especially useful for new Toyotas or leases. It ensures you do not pay extra after a total loss.

Credit: www.philmeadortoyota.com

Key Coverage Features

Toyota Gap Insurance offers important protection for car owners. It covers the difference between what you owe on your vehicle and its current value. This coverage helps avoid large out-of-pocket costs if your car is totaled or stolen.

Understanding the key features of this insurance helps you see its value. It protects your financial investment and gives peace of mind. Below are the main coverage areas of Toyota Gap Insurance.

Coverage Of Loan Or Lease Balance

Toyota Gap Insurance pays the remaining loan or lease balance. If your car is totaled, your regular insurance may not cover the full amount owed. Gap insurance covers this difference. It protects you from owing money on a car you no longer have.

Protection Against Depreciation

New cars lose value quickly after purchase. This is called depreciation. Toyota Gap Insurance covers the gap caused by depreciation. It ensures you are not stuck paying more than your car is worth. This helps especially in the first few years of ownership.

Handling Total Loss Situations

If your car is declared a total loss, your insurance pays its actual cash value. This value may be less than your loan or lease payoff. Gap insurance covers the shortfall. It prevents you from paying a large sum for a car you cannot use.

Benefits For Toyota Owners

Gap insurance offers real value to Toyota owners. It protects your finances if your car is totaled or stolen. This coverage fills the gap between what you owe and what your insurance pays.

Owning a Toyota often means financing the vehicle. Gap insurance helps manage risks during this period. It provides safety and reduces stress about unexpected costs.

Financial Security After Accidents

Accidents can leave you with a big debt. Your regular insurance may not cover the full loan balance. Gap insurance pays the difference, preventing extra financial burden.

This means you won’t owe money on a car you no longer have. It helps keep your budget safe and your credit in good shape.

Peace Of Mind During Vehicle Financing

Financing a Toyota can take years to pay off. Gap insurance offers peace of mind during this time. You avoid worries about owing more than the car’s value.

Knowing gap insurance is in place helps you focus on daily life. It removes stress about sudden losses or theft.

Reduced Out-of-pocket Expenses

Without gap insurance, you might pay a large sum after a loss. Gap insurance reduces these costs by covering the difference. It helps you avoid dipping into savings or credit cards.

This coverage makes recovering from accidents easier and less costly. It protects your wallet and keeps your finances stable.

Eligibility And Enrollment

Understanding who qualifies for Toyota Gap Insurance and the right time to enroll helps protect your investment. Gap insurance covers the difference between what you owe on a vehicle and its actual value if it is totaled or stolen. Knowing the eligibility rules and enrollment timing ensures you get the coverage you need without delays.

Who Can Get Toyota Gap Insurance?

Anyone who finances or leases a new Toyota can usually get gap insurance. It applies to buyers who owe more than their car’s worth. Toyota Gap Insurance helps cover that difference in case of total loss.

Not all vehicles may qualify. Generally, the car must be bought or leased through an authorized Toyota dealer. The insurance is designed for new or nearly new cars. Older or high-mileage cars might not be eligible.

When To Purchase Gap Insurance

Gap insurance should be purchased at the time of buying or leasing your Toyota. Dealers often offer it along with your financing paperwork. Buying early guarantees coverage from the first day you drive your car.

You can also add gap insurance during the loan or lease term. However, the best protection comes from enrolling right away. Waiting may risk having no coverage if an accident happens.

Claim Process And Requirements

The claim process for Toyota Gap Insurance is straightforward. Understanding the steps helps you get your claim approved quickly. Knowing the requirements avoids delays and confusion.

Filing A Gap Insurance Claim

Start by contacting your Toyota insurance provider. Report the total loss or theft of your vehicle. Provide clear details about the accident or incident. Follow the instructions given by the insurance agent. They will guide you through the next steps. Timely filing is important to speed up the process.

Documents Needed For Approval

Gather all necessary documents before submitting your claim. You will need a copy of the police report. Include the original loan or lease agreement. Provide the vehicle’s title and registration papers. Submit a copy of the insurance policy. Sometimes, a repair estimate or total loss statement is required. Having these ready helps your claim get approved faster.

Cost Factors And Payment Options

Understanding the cost factors and payment options for Toyota Gap Insurance helps you plan better. Knowing what affects the price and how to pay makes buying easier. This section breaks down these details clearly.

Pricing Influences

The price of Toyota Gap Insurance changes based on several things. The car’s value plays a big role. Newer and more expensive cars usually cost more to insure. The loan amount also matters. Higher loans mean higher insurance costs.

Your location affects the price too. Some areas have higher risks of theft or accidents. This makes insurance more expensive there. The length of the loan or lease impacts the price. Longer terms might increase the cost.

Your credit score can influence the rate. Better credit often leads to lower prices. Each insurance provider has its own pricing rules. So, prices might vary depending on where you buy it.

Payment Methods And Plans

Many options exist to pay for Toyota Gap Insurance. You can pay the full amount upfront. This avoids extra fees and is simple. Some providers allow monthly payments. This spreads the cost over time.

Payment through your car loan or lease is possible. This means you pay insurance along with your car payments. Some companies offer automatic payments. This option helps avoid missed payments.

Check if your provider accepts credit cards, bank transfers, or checks. Choose the method that fits your budget and schedule best. Clear payment plans make managing insurance costs easier.

Comparing Gap Insurance With Other Coverage

Understanding how Toyota Gap Insurance compares to other types of coverage helps you choose the best protection. Each insurance type covers different risks and situations. Knowing these differences ensures you avoid gaps in your coverage and costly expenses.

Differences From Standard Auto Insurance

Standard auto insurance pays for damages or theft based on your car’s current value. It does not cover the full amount you owe on your loan or lease. Gap insurance covers the difference between the car’s value and the remaining loan balance. This is important if your car is totaled or stolen early in the loan period. Standard insurance protects your car. Gap insurance protects your finances.

Alternatives To Toyota Gap Insurance

Some lenders or dealers offer similar gap coverage as part of your financing deal. These options may have different terms or costs. Another alternative is to buy an aftermarket gap insurance policy from other companies. You can also consider paying off your loan faster to reduce risk. Each alternative has pros and cons. Check details carefully before deciding.

Credit: www.chuckhuttontoyota.com

Tips For Maximizing Benefits

Maximizing the benefits of Toyota Gap Insurance helps protect your finances. This insurance covers the difference between your car’s value and what you owe. Using some simple tips ensures you get the most from your coverage. Understanding how to manage your policy and avoiding mistakes keeps your protection strong.

Maintaining Proper Coverage

Review your policy regularly. Check if the coverage matches your loan or lease balance. Update your insurance if you pay down your loan. Keep your contact information current with your insurer. Always report any changes in your vehicle or loan status. Proper coverage prevents gaps that can cost you money.

Avoiding Common Pitfalls

Do not cancel your GAP insurance early. Canceling too soon may leave you at risk. Avoid assuming your standard auto insurance covers the gap. It usually does not. Read your policy details carefully to know what is covered. Avoid missing premium payments to keep coverage active. These steps prevent surprises during a claim.

Frequently Asked Questions

What Is Toyota Gap Insurance?

Toyota Gap Insurance covers the difference between your car’s loan balance and its value.

Does Toyota Gap Insurance Cover Total Car Loss?

Yes, it helps pay the remaining loan if your car is stolen or totaled.

How Does Toyota Gap Insurance Work With Loans?

It pays the gap between your car’s market value and what you owe on your loan.

Is Toyota Gap Insurance Different From Regular Insurance?

Yes, it covers loan differences, while regular insurance covers damage or theft only.

Can Toyota Gap Insurance Save Me Money After A Crash?

It can save you from paying the loan balance out of pocket after a total loss.

Who Should Consider Buying Toyota Gap Insurance?

People with loans or leases, especially if they owe more than the car’s worth.

Conclusion

Toyota Gap Insurance helps cover the difference if your car is totaled. It pays what your insurance does not, saving you money. This coverage protects you from owing more than the car’s value. It works alongside your regular auto insurance policy.

Knowing what it covers can give you peace of mind. Consider your financial situation and vehicle loan before deciding. Gap insurance can be a smart choice for many Toyota drivers. It offers extra protection without extra hassle. Think carefully and choose the coverage that fits you best.

As an Amazon Associate, I earn from qualifying purchases