As an Amazon Associate, I earn from qualifying purchases

If you’re buying a Toyota, you might be wondering how much gap insurance costs and if it’s worth it for you. Gap insurance can protect you from paying out of pocket if your car is totaled or stolen, but the price can vary.

Understanding the real cost of gap insurance for your Toyota will help you make smarter decisions and avoid surprises later. Keep reading to find out exactly what you need to know about gap insurance pricing, so you can protect your investment without overspending.

Credit: www.eddystoyota.com

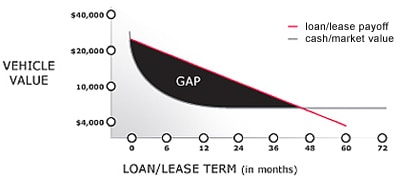

What Is Gap Insurance

Gap insurance is a special kind of car insurance. It helps cover the difference between what you owe on your car and its actual value. This is useful if your car is totaled or stolen. Standard insurance may not pay this full difference. Gap insurance fills that gap.

Purpose Of Gap Insurance

Gap insurance protects you from financial loss. It covers the remaining loan balance if your car is a total loss. Sometimes, cars lose value quickly after purchase. You might owe more than the car’s worth. Gap insurance pays the difference. It prevents you from paying out of pocket for a car you no longer have.

How It Works With Toyota Vehicles

When you buy a Toyota, you can add gap insurance to your plan. If your Toyota is totaled, your insurer pays the car’s current value. Then, gap insurance covers the leftover loan amount. This helps if your Toyota’s market value is less than your loan balance. It ensures you don’t owe money on a car you cannot use. Toyota dealers often offer gap insurance as part of financing.

Factors Affecting Gap Insurance Costs

Gap insurance costs for Toyota depend on several important factors. These factors affect the price and coverage of your policy. Understanding them helps you find the best deal.

Each element changes how much you pay. Knowing these details makes your choice clearer. Here are the key factors that impact gap insurance costs.

Vehicle Model And Age

The model and age of your Toyota affect gap insurance rates. Newer models usually cost more to insure. They have higher values and repair costs.

Older vehicles may have lower premiums. Their value decreases over time. The gap insurance covers the difference if your car is totaled.

Loan Or Lease Terms

The length and type of your loan or lease influence costs. Longer loan terms often increase gap insurance prices. The risk for insurers is higher over more months.

Lease agreements often require gap insurance. This protects the leasing company. The terms of your contract affect your premium amount.

Location And Provider

Your location plays a big role in pricing. Some areas have higher accident rates or theft risks. These increase gap insurance costs.

Different insurance providers also set varied rates. Shopping around helps find competitive offers. Provider policies and discounts impact final prices.

Average Gap Insurance Rates For Toyota

Gap insurance helps cover the difference between what you owe on your Toyota and its actual cash value. Knowing the average cost of this insurance can help you plan better. Gap insurance rates vary by model, location, and provider. Understanding typical rates for Toyota vehicles gives you a clear idea of what to expect.

Typical Price Ranges

Gap insurance for Toyota usually costs between $400 and $700. This price can be a one-time fee or spread over monthly payments. Smaller cars like the Toyota Corolla often have lower rates. Larger models like the Toyota Highlander may cost more. Rates depend on the vehicle’s price and loan terms.

Comparison With Other Brands

Toyota’s gap insurance rates are generally average. Brands like Honda and Ford offer similar prices. Luxury brands such as BMW or Lexus tend to charge higher rates. Economy brands like Hyundai may have slightly cheaper coverage. Toyota strikes a balance between cost and coverage quality.

Credit: www.toyotaoftacoma.com

Ways To Save On Gap Insurance

Gap insurance protects you if your Toyota is totaled or stolen. It covers the difference between what you owe and the car’s value. Saving money on gap insurance is possible with a few smart choices. These tips help you pay less without losing important coverage.

Bundling With Other Policies

Many insurance companies offer discounts for bundling policies. You can combine gap insurance with car or home insurance. Bundling lowers your total premium cost. Check if your insurer has package deals for multiple policies.

Choosing The Right Coverage

Not all gap insurance plans are the same. Select coverage that fits your loan amount and car value. Avoid paying for extra coverage you don’t need. A tailored plan helps reduce your monthly payments.

Shopping Around For Quotes

Prices for gap insurance vary by provider. Get quotes from several companies before deciding. Comparing rates helps find the best price for your Toyota. Use online tools to get quick estimates from top insurers.

Buying Gap Insurance From Toyota

Buying gap insurance from Toyota offers a simple way to protect your investment. It covers the difference between your car’s value and what you owe. This coverage can save you money if your vehicle is totaled or stolen. Understanding your options at the dealership helps you decide if dealer coverage fits your needs.

Options At The Dealership

Toyota dealerships offer gap insurance as an add-on to your auto loan or lease. You can buy it when you purchase your car or within a short time after. The coverage usually lasts as long as your loan or lease term. Prices vary by state and loan amount but often range from $400 to $700. The dealer handles the paperwork, making it easy to add gap insurance to your contract.

Pros And Cons Of Dealer Coverage

Dealer gap insurance is convenient and simple to get. It bundles with your auto loan, so you pay monthly with your car payments. The dealership offers trusted coverage designed for Toyota vehicles. On the downside, dealer coverage can be more expensive than outside policies. You may find better rates through your insurance agent or online. Also, cancelling dealer gap insurance before your loan ends can be tricky and may cost extra fees.

Alternative Gap Insurance Providers

Gap insurance helps cover the difference between what you owe on your Toyota and its value after a loss. Toyota offers its own gap insurance, but many drivers choose alternatives. These providers often offer competitive prices and flexible terms. Exploring other options can save money and provide the right coverage for your needs.

Third-party Insurers

Third-party insurers are companies separate from Toyota. They offer gap insurance policies tailored to various vehicles. These insurers may provide lower rates than dealer options. Some have flexible payment plans to suit different budgets. Comparing quotes from multiple insurers can find the best deal. Many third-party providers have clear terms without hidden fees.

Online Insurance Platforms

Online insurance platforms simplify buying gap insurance. You can compare prices from many companies in one place. These websites often show side-by-side coverage details. Online platforms save time and effort. Many offer instant quotes and easy policy management. Reading customer reviews helps choose a reliable provider. Buying online suits those who prefer a quick, digital process.

When Gap Insurance Is Worth It

Gap insurance is not always necessary. It depends on your situation and financial risk. This type of coverage helps when your car’s loan balance is higher than its value. Knowing when gap insurance is worth it can save you money and stress.

Situations That Benefit Drivers

Gap insurance helps drivers with loans or leases. New cars lose value quickly in the first year. If you owe more than the car’s worth, gap coverage pays the difference. It protects you from big out-of-pocket costs after a total loss. People who put little money down or have long loans benefit most. Also, those who drive a lot or face high depreciation should consider gap insurance.

Risks Of Skipping Gap Coverage

Without gap insurance, you pay the difference if your car is totaled. Insurance only covers the car’s current market value. This amount might be less than your loan or lease balance. You could owe thousands even with full coverage. Skipping gap coverage means risking large debt after an accident. It can lead to financial hardship, especially if you cannot pay off the loan quickly.

Credit: www.westcoasttoyotalb.com

Frequently Asked Questions

How Much Does Toyota Gap Insurance Usually Cost?

Toyota gap insurance typically costs between $400 and $700 for the entire policy term.

Does Toyota Offer Gap Insurance With Every New Car?

Toyota offers gap insurance as an optional add-on, not automatically included with every new car.

Can I Buy Toyota Gap Insurance After Purchasing A Car?

Yes, Toyota gap insurance can be purchased within the first 12 months of buying your car.

Is Toyota Gap Insurance Cheaper Than Third-party Providers?

Toyota gap insurance prices can be higher, but it ensures full coverage for Toyota vehicles.

How Does Toyota Gap Insurance Save Me Money?

It covers the difference between your car’s value and what you owe on your loan.

Is Gap Insurance Necessary For All Toyota Car Buyers?

Gap insurance is recommended if you have a loan or lease and owe more than car value.

Conclusion

Gap insurance for Toyota helps protect your finances after an accident. The cost depends on your car’s value and loan terms. It usually adds a small amount to your monthly payment. This insurance covers the difference between what you owe and the car’s worth.

Choosing gap insurance can bring peace of mind. It is worth considering if you want extra financial safety. Always compare prices and read the policy carefully. Protect yourself from unexpected costs with gap insurance for Toyota.

As an Amazon Associate, I earn from qualifying purchases